_20628.jpg)

Tuesday, 18 March 2025

EU funding for French enrichment plant expansion

_20628.jpg)

Monday, 10 March 2025

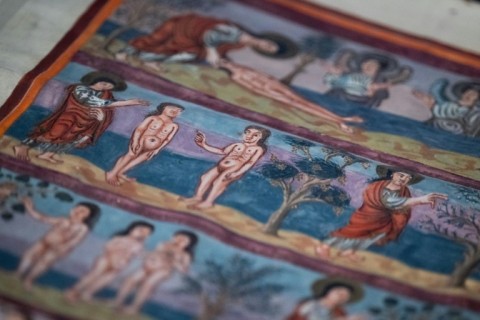

Priceless ninth-century masterpiece Bible returns to Swiss homeland

Wednesday, 26 February 2025

AI regulation around the world

Tuesday, 12 November 2024

Belgians Grow Heaviest Pumpkin in Europe–Weighing as Much as a Honda Civic

Thursday, 5 September 2024

If Australia wants to fast-track 100% renewables, it must learn from Europe’s risky path

Even after decades encouraging the growth of renewables, we’re still too reliant on coal and gas power stations.

The problem isn’t in our ability to generate clean power. It’s what happens after that. Major roadblocks include the need for 10,000 kilometres of new transmission lines to connect rural renewable farms with city consumers. Another oft-cited reason is the need to store power from renewables so it can be drawn on as needed. This is why the Australian Energy Market Operator sees such a big role for large-scale storage coupled with some flexible gas as a backup.

Last year, renewable investment actually shrank in Australia. Reasons for the slowdown are wide-ranging. Some are local, such as rural communities lobbying against new transmission lines, the need for planning and environmental approvals and the slow pace of creating new regulations. Others are global, such as increased competition for engineers and electricians, clean tech and raw materials.

As climate change worsens, frustration about the slow pace of change will intensify. But when we look around the world, we see similar challenges cropping up in many countries.

What’s in it for locals? Securing a social license for transmission lines is shaping up as a major source of delay in Australia’s energy transition. David L Young/Shutterstock

What’s in it for locals? Securing a social license for transmission lines is shaping up as a major source of delay in Australia’s energy transition. David L Young/ShutterstockEuropean Union

Transmission line hold-ups are by no means a delay unique to Australia. Data from the International Energy Agency shows building new electricity grid assets takes ten years on average in both Europe and the United States.

In 2022, the European Union introduced laws expressly aimed at speeding up the clean energy transition by fast-tracking permits for renewables, grid investment and storage assets. These investments, the laws state, are:

presumed as being in the overriding public interest […] when balancing legal interests in the individual case.

That is, when the interests of other stakeholders – including local communities and the environment – clash with clean energy plans, clean energy has priority.

Germany has gone further still with domestic laws designed to further streamline planning and approvals and favour energy transition projects over competing interests. These changes were sweetened with financial incentives for communities participating in clean energy projects.

This is a risky path. European leaders have chosen to go faster in weaning off fossil fuels at the risk of inflaming local communities. The size of the backlash became clear in the EU’s elections in June, where populists gained seats and environmental parties lost.

United States

In 2022, the US government passed a huge piece of green legislation known as the Inflation Reduction Act. Rather than introducing further regulations, the US has gone for a green stimulus, offering A$600 billion in grants and tax credits for companies investing in green manufacturing, electric vehicles, storage and so on. To date, this approach has been very effective. But money isn’t everything – new transmission lines will be essential, which means approvals, planning, securing the land corridor and so on.

This year, the US Energy Department released new rules bundling all federal approvals into one program in a bid to accelerate the building of transmission lines across state borders.

Australia could borrow from this. The government’s Future Made in Australia policy package takes its cues from US green stimulus, but at smaller scale. What America’s example shows us is these incentives work – especially when big.

US-style streamlining and bundling of approvals could address delays from overlapping state and federal approvals. Supporting local green manufacturing can create jobs, which in turn encourages community buy-in.

China

Even as Australia’s clean energy push hit the doldrums and emission levels stagnated, China’s staggering clean energy push began bearing fruit. Emissions in the world’s largest emitter began to fall, five years ahead of the government’s own target.

They did this by covering deserts with solar panels, building enormous offshore wind farms, rolling out fast rail, building hydroelectricity, and taking up electric vehicles very rapidly. In 2012, China had 3.4 gigawatts of solar and 61 GW of wind capacity. In 2023, it had 610 GW of solar and 441 GW of wind. It’s also cornered the market in renewable technologies and moving strongly into electric vehicles.

Of course, China’s government has far fewer checks and balances and exerts tight control over communities and media. We don’t often see what costs are paid by communities.

China has also used industrial policy cleverly, with government and industries acting in partnership. In fact, the green push in the US, EU, Australia and other Western jurisdictions takes cues from China’s approach.

There’s still a long road ahead for China. But given its reliance on energy-intensive manufacturing, it’s remarkable China’s leaders have managed to halt the constant increase in emissions.

Acceleration has a cost

These examples show how it is possible to accelerate the energy transition. But often, it comes at a cost.

Costs can be monetary, such as when governments direct funding to green stimulus over other areas. But it can also be social, if the transition comes at the cost of community support or the health of the local environment.

This comes with the territory. Big infrastructure projects benefit many but disadvantage some.

While Australian governments could place climate action above all else as the EU is doing, they would risk community and political blowback. Long-term progress means doing the work to secure local support.

For instance, Victoria’s new Transmission Investment Framework brings communities to the fore, focusing on their role and what they will stand to gain early on.

Yes, this approach may slow the rate at which wind turbines go up and solar is laid down. But it may ensure public support over the long term.

No one said the shift to green energy would be easy. Only that it is necessary, worthwhile – and possible. ![]()

Anne Kallies, Senior Lecturer in Energy Law, RMIT University

This article is republished from The Conversation under a Creative Commons license. Read the original article.

Friday, 14 June 2024

'Europe in miniature': Welcome to Baarle, world's strangest border

Tuesday, 4 June 2024

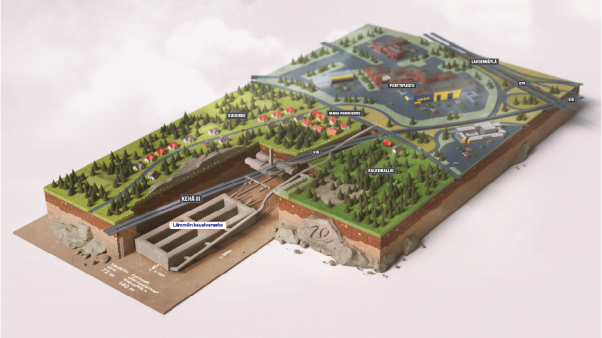

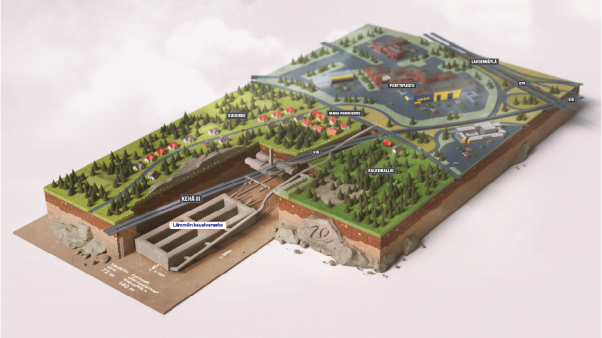

Waste Heat Generated from Electronics to Warm Finnish City in Winter Thanks to Groundbreaking Thermal Energy Project

Wednesday, 29 May 2024

For Europe to emulate Silicon Valley’s tech success, it should change its startup funding model

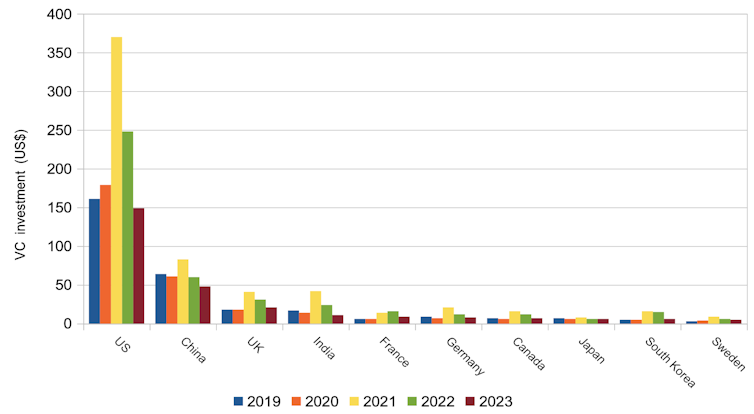

Tech startups will be enthused by the news that Silicon Valley venture capital (VC) veteran General Catalyst is on the verge of raising US$6 billion (£4.8 billion) for backing new companies. It comes hot on the heels of an announcement from Andreessen Horowitz, another major VC, of a new US$7.2 billion investment fund. These are among the largest fundraisings in years, coming at a time when the VC sector has been going through a lull, with worldwide total investments down from US$644 billion in 2021 to US$286 billion in 2023.

You can listen to more articles from The Conversation, narrated by Noa.

The bad news, depending on where you live, is that most of the proceeds are likely to be invested Stateside. American startups mop up around half of all global VC funding, while Europe and the UK are lucky to see a quarter. This is despite the fact that Europe and the UK have a slightly larger share of world GDP than the US (17% v 16%).

VC investment by country (US$)

This helps to explain why America’s leading three tech firms, Microsoft, Apple and Nvidia, are worth around US$7.5 trillion, while Europe’s equivalents, ASML, SAP and Prosus, are worth some US$700 billion. So what can be done to change this situation?

Silicon Valley’s edge

Silicon Valley’s success can be attributed to a range of mutually reinforcing factors, many of which planted their seeds decades ago. These include lucrative government contracts, entrepreneurial universities nearby, and the accumulation of wealth and talent from tech giants such as Apple, Nvidia, and OpenAI. This kind of head start is difficult to replicate.

US investors often plough millions of dollars into relatively early-stage companies, which are sums that other ecosystems simply cannot match. But startups typically first need to demonstrate traction with customers, usually in the form of sales revenue or user numbers. This is different from tech investment hubs such as Berlin and Scotland, where investors tend to only require a strong team with just an idea for the startup to be considered to have good potential for investment. Our research suggests that this might be an underappreciated reason for Silicon Valley’s success.

Having done in-depth interviews with 63 entrepreneurs and investors across Silicon Valley and Berlin, the different expectations of investors are very noticeable. For instance, the founders of San Francisco-based AirBnb had to use their credit cards to keep the company afloat, and even resorted to selling cereal boxes before eventually securing funding.

Similarly, the founders of food delivery app DoorDash, which is also based in San Francisco, built a full prototype and were making the deliveries themselves for nearly half a year before raising their first round of investment.

This is in stark contrast to European ecosystems. Recent examples from Berlin include language tutor marketplace HeyLama, which secured funding nearly immediately after inception. Meanwhile, pet care startup Rex raised more than US$5 million within months after launching.

And yet, between 2020 and 2022, US$44 billion was invested in early-stage deals in Silicon Valley as opposed to US$5.8 billion in Berlin. Equally, roughly 31% of US but only 19% of European seed-stage startups progress to the next round of fundraising.

This doesn’t necessarily mean that the companies that do not raise follow-on funding fail, but it may help explain why Silicon Valley’s exits amount to US$403 million on average, as opposed to US$53 million in Berlin.

So why is it not the case that US startups struggle more when they have to meet higher expectations to get funded? And could other ecosystems catch up by adopting the same strategy?

The ‘valley of death’

The journey of a business idea from inception to early traction is often referred to as the “valley of death”. During this period, the startup needs to keep developing the business, build the product, and figure out a reliable business model. There is no one-size-fits-all blueprint and many companies fail, either because the idea is not viable or they run out of money.

Silicon Valley’s preferred funding model of investing into startups with traction somewhat decreases the risk of failure for VCs. In the long term this should result in more funds for reinvesting into new startups, which likely helped the whole ecosystem to flourish. There’s also a benefit to those entrepreneurs who can delay fundraising until they can demonstrate traction, since the startup is likely to be worth more. This means they can get more money or give up a smaller percentage of the business.

This would suggest that European startup ecosystems ought to think about moving towards this model. But it comes with a major downside. Few entrepreneurs have enough money to maintain the company through the valley of death – and it tends to be longer and deeper for the most innovative ideas. This is particularly an issue for entrepreneurs from under-represented groups, such as disadvantaged socioeconomic backgrounds, women and immigrants, who are less likely to have the necessary resources or connections. Thus, adopting the American investment threshold could make the startup world even more inaccessible to them.

To get the benefits of the US system without damaging diversity, there need to be support structures in place, such as incubator and accelerator programmes, to help startups gain traction. Even so, these need to be designed carefully to ensure they signal credibility, and therefore help – rather than hinder – the incubated companies to secure their first round of investment.![]()

Michaela Hruskova, Lecturer in Entrepreneurship, University of Stirling and Katharina Scheidgen, Chair of Entrepreneurship and Innovation, Georg-August-Universität Göttingen

This article is republished from The Conversation under a Creative Commons license. Read the original article.

Wednesday, 15 May 2024

UK SMBs could save 280m tonnes of CO2e by hitting 2030 targets

Friday, 10 May 2024

Electric cars pile up at European ports as Chinese firms struggle to find buyers

China’s automotive industry has revolutionised over the past decade, from producing basic western clones to making cars that equal the world’s best. As the manufacturing powerhouse of the world, China is also producing them in huge volumes.

However, Chinese cars are facing difficulties in finding buyers in Europe. Imported cars, many of which are Chinese electric vehicles, are piling up at European ports, with some spending up to 18 months in port car parks as manufacturers struggle to get them onto people’s driveways.

Why is this, though? Chinese electric vehicles in particular are getting positive reviews. Having driven them myself, I can attest to them matching, or even exceeding, the well-known European brands in range, quality and technology.

But entering an established market as a challenger is a complex operation. Chinese makers will have to contend with buyer wariness, a lack of brand image, trade protectionism and rapid outdatedness.

Lack of buyer faith

China’s automotive expansion programme draws parallels with the moves made by Japan in the 1960s and 70s. At that time, the product coming from Japan was commendable but lacked the finesse, design and longevity of their western counterparts. Japanese cars were thought of as tinny, underpowered and susceptible to rusting, as well as looking very generic compared to stylish European designs.

Memories of Japan’s involvement in the second world war were also fresh in (particularly American) buyer’s minds, who were slow to forgive a nation that launched the Pearl Harbour attacks. However, by constantly focusing on a reliable, relatively cheap and increasingly stylish product, Japan slowly turned this around to become the automotive powerhouse of the 1990s and 2000s.

China is viewed with suspicion by many westerners, and its carmakers are similarly hampered by their recent legacy of producing both endorsed and illegal clones of European cars. But with the lessons of the Japanese to learn from, Chinese cars are rapidly advancing to match and exceed existing alternatives.

Strategic purchases of brands like Volvo, Lotus and MG have also given China existing brands that are respected and, more importantly, have some of the best engineering knowledge in the world.

Yet, even after buying up western brands, Chinese automakers have proven unable to buy loyalty from existing customers of brands like BMW, Porsche, Ferrari and Ford. For these buyers, the history of the brand in terms of known reliability and even things like motor sport success is something that Chinese makers, like the Japanese, will have to build up over time.

It was Ford dealers who, in the 1960s, coined the phrase: “Win on Sunday, Sell on Monday”. The phrase is as an adage to attest the fact that if buyers see a car winning a race, they’ll be motivated to go out and buy one.

Existing manufacturers also have a legacy of reliability that buyers have experienced for themselves, giving a huge brand loyalty benefit. Add to this a lack of an established dealer network outside of China and you see how Chinese makers struggle against the established competition.

A challenging trade environment

China has a price advantage compared to Europe or the US. Economies of scale, excellent shipping links and cheap labour mean that Chinese cars are cheaper both to make and buy.

However, in many countries they are subject to high import tariffs. The EU currently imposes a 10% import tariff on each car brought in. And in the US, car imports from China are subject to a 27.5% tariff.

These tariffs may well rise further. The EU is conducting an investigation into whether its tariff is too low. If it concludes this later this year, higher duties will be applied retrospectively to imported cars.

Cars, and specifically electric vehicles, are also in a phase of their development where they see rapid changes and updates. Traditionally, vehicle models would see a market life of between four and seven years, perhaps with small updates in trim, colour palette or feature availability.

But Tesla has turned this on its head. The Tesla Model S, for example, has seen almost continuous product updates that make it barely recognisable in terms of hardware from a car released in 2012. Chinese automakers have taken note. They are bringing out new models around 30% faster than in most other nations.

Tesla is supporting owners of older cars with upgrades, at extra expense, to bring them in line with the latest hardware. Without guaranteed software support like this, the rate at which Chinese automakers are bringing out new models could make buyers wary that the product they have bought will soon become outdated compared to buying a car on a more traditional update cycle.

How to succeed

Many of these factors can be fixed. They also chime more with private buyers than business buyers, who are more concerned with cost. Chinese makers would be well-advised to push harder into this market.

In the UK, the fleet market dwarfs the private market, and the situation is similar in Europe. Selling en masse to fleets and rental companies gets more cars on the road and allows more data about reliability to feed into the market.

The road to succeeding in a new market such as the EU will be slow and bumpy. But it’s clear that China is laser focused on its global push. It remains to be seen whether this lack of buyers can be turned around.

This article is republished from The Conversation under a Creative Commons license. Read the original article.

Monday, 6 May 2024

VMO2: Celebrating a century of connectivity

Tuesday, 16 April 2024

Waste Heat Generated from Electronics to Warm Finnish City in Winter Thanks to Groundbreaking Thermal Energy Project

An illustration of Varanto’s seasonal energy storage facility – credit, Varanto Energy, released

An illustration of Varanto’s seasonal energy storage facility – credit, Varanto Energy, releasedThursday, 4 April 2024

Germany aims to build fusion power plant

.jpg?ext=.jpg) Bettina Stark-Watzinger announcing the new fusion research funding programme (Image: BMBF)

Bettina Stark-Watzinger announcing the new fusion research funding programme (Image: BMBF)Friday, 22 March 2024

For World Happiness Day, Finland Wants to Bring 5 Winners to World’s Happiest Country–Crowned 7 Years in a Row