Thursday, 3 April 2025

Shakira concerts give multimillion-dollar boost to Mexico

Friday, 17 January 2025

World Bank looks to fresh beginning in Sri Lanka

Tuesday, 10 December 2024

World Bank announces record $100bn support for world's poorest countries

Thursday, 28 November 2024

International banks express support for nuclear expansion

Thursday, 24 October 2024

International banks express support for nuclear expansion

Monday, 14 October 2024

EU backs tougher tax rules on crypto transactions

Saturday, 29 June 2024

Bangladesh receives 1.15 billion dollars from IMF

Wednesday, 26 June 2024

World Bank says 80% of global population will experience slower growth than in pre-COVID decade

- Latest Global Economic Prospects report acknowledges global growth stabilising for first time in three years

- The global economy is expected to stabilise for the first time in three years in 2024—but at a level that is weak by recent historical standards, according to the World Bank’s latest Global Economic Prospects report released on Thursday.

- Global growth is projected to hold steady at 2.6% in 2024 before edging up to an average of 2.7% in 2025-26. That is well below the 3.1% average in the decade before COVID-19. The forecast implies that over the course of 2024-26 countries that collectively account for more than 80% of the world’s population and global GDP would still be growing more slowly than they did in the decade before COVID-19.

- Overall, developing economies are projected to grow 4% on average over 2024-25, slightly slower than in 2023. Growth in low-income economies is expected to accelerate to 5% in 2024 from 3.8% in 2023. However, the forecasts for 2024 growth reflect downgrades in three out of every four low-income economies since January. In advanced economies, growth is set to remain steady at 1.5% in 2024 before rising to 1.7% in 2025.

- “Four years after the upheavals caused by the pandemic, conflicts, inflation, and monetary tightening, it appears that global economic growth is steadying,” said World Bank Group’s Chief Economist and Senior Vice President Indermit Gill. “However, growth is at lower levels than before 2020. Prospects for the world’s poorest economies are even more worrisome. They face punishing levels of debt service, constricting trade possibilities, and costly climate events. Developing economies will have to find ways to encourage private investment, reduce public debt, and improve education, health, and basic infrastructure. The poorest among them—especially the 75 countries eligible for concessional assistance from the International Development Association—will not be able to do this without international support.”

- This year, one in four developing economies is expected to remain poorer than it was on the eve of the pandemic in 2019. This proportion is twice as high for countries in fragile- and conflict-affected situations. Moreover, the income gap between developing economies and advanced economies is set to widen in nearly half of developing economies over 2020-24—the highest share since the 1990s. Per capita income in these economies—an important indicator of living standards—is expected to grow by 3.0% on average through 2026, well below the average of 3.8% in the decade before COVID-19.

- Global inflation is expected to moderate to 3.5% in 2024 and 2.9% in 2025, but the pace of decline is slower than was projected just six months ago. Many central banks, as a result, are expected to remain cautious in lowering policy interest rates. Global interest rates are likely to remain high by the standards of recent decades—averaging about 4% over 2025-26, roughly double the 2000-19 average.

- “Although food and energy prices have moderated across the world, core inflation remains relatively high—and could stay that way,” said World Bank’s Deputy Chief Economist and Prospects Group Director Ayhan Kose. “That could prompt central banks in major advanced economies to delay interest-rate cuts. An environment of ‘higher-for-longer’ rates would mean tighter global financial conditions and much weaker growth in developing economies.”

- The latest Global Economic Prospects report also features two analytical chapters of topical importance. The first outlines how public investment can be used to accelerate private investment and promote economic growth. It finds that public investment growth in developing economies has halved since the global financial crisis, dropping to an annual average of 5% in the past decade. Yet public investment can be a powerful policy lever. For developing economies with ample fiscal space and efficient government spending practices, scaling up public investment by 1% of GDP can increase the level of output by up to 1.6% over the medium term.

- The second analytical chapter explores why small states—those with a population of around 1.5 million or less—suffer chronic fiscal difficulties. Two-fifths of the 35 developing economies that are small states are at high risk of debt distress or already in it. That’s roughly twice the share for other developing economies. Comprehensive reforms are needed to address the fiscal challenges of small states. Revenues could be drawn from a more stable and secure tax base. Spending efficiency could be improved—especially in health, education, and infrastructure. Fiscal frameworks could be adopted to manage the higher frequency of natural disasters and other shocks. Targeted and coordinated global policies can also help put these countries on a more sustainable fiscal path.World Bank says 80% of global population will experience slower growth than in pre-COVID decade | Daily FT

Sunday, 23 June 2024

World Bank announces new Country Director for Maldives, Nepal, and Sri Lanka

Wednesday, 19 June 2024

IMF Executive Board approves second review on SL

- The Executive Board of the International Monetary Fund (IMF) yesterday passed the second review of Sri Lanka’s $ 3 billion Extended Fund Facility (EFF) program.

- The move entails the release of $ SDR 254 million (about $ 337 million) bringing the total IMF financial support disbursed under the arrangement to SDR 762 million (about $ 1 billion).

- The first review was held on 12 December last year

- “All the Directors highly appreciate the authority’s commitment to the program which they say has yielded positive macroeconomic results,” said a Government source.

- Based on the breakthrough though anticipated, President Ranil Wickremesinghe is scheduled to make a statement today along with a comprehensive economic update and referring to the remarkable International endorsement of Sri Lanka’s economic turnaround.

- Foreign Affairs Minister Ali Sabry said the IMF approval was a testament to the Government’s dedication to driving forward economic reforms and securing a prosperous future for all Sri Lankans. State Minister of Finance Shehan Semasinghe is also scheduled to brief the media today morning. IMF Executive Board approves second review on SL | Daily FT

Saturday, 15 June 2024

Digital Wallets Are Popular in the UK While Demand for A2A Payments to Be Desired Finds WorldPay

Worldpay, the global paytech, has published the findings from its Global Payments Report 2024, revealing that digital wallets are expected to comprise half of all e-commerce spending in the UK, worth £203.5billion, by 2027.

Worldpay, the global paytech, has published the findings from its Global Payments Report 2024, revealing that digital wallets are expected to comprise half of all e-commerce spending in the UK, worth £203.5billion, by 2027.Monday, 3 June 2024

IMF hails Sri Lanka’s strong program performance

- Next steps on debt restructuring are to conclude negotiations with external private creditors

- Says official creditors side agreements in principle still need to be finalised

Wednesday, 22 May 2024

‘Investing in women is a human right issue’

Tuesday, 21 May 2024

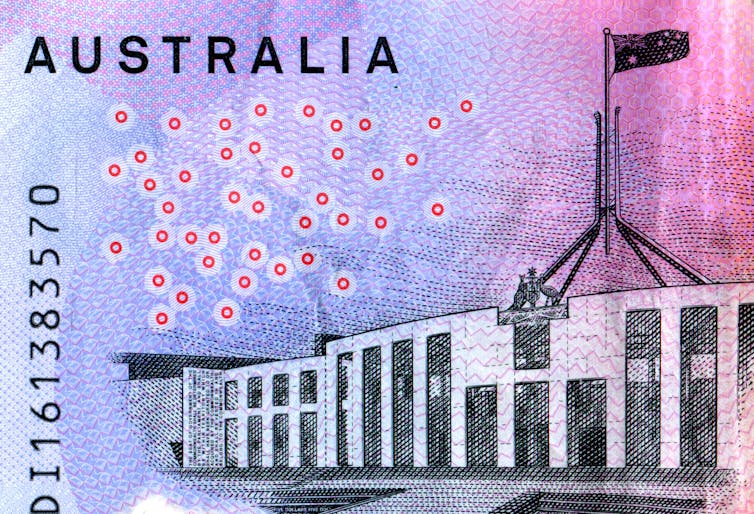

What’s the difference between fiscal and monetary policy?

This article is part two of The Conversation’s “Business Basics” series where we ask leading experts to discuss key concepts in business, economics and finance.

How governments should manage their budgets, and how interest rates should be set, are two of the most important questions in economics.

Ideally, both work hand in hand to ensure the best outcomes for the economy as a whole. But they are enacted by different branches of government, and fall into different buckets within economics.

Budgeting – the way governments tax and spend – falls within the domain of fiscal policy. In contrast, the management of credit and interest rates falls into the domain of monetary policy.

With the recent federal budget handed down amid an ongoing battle to tackle inflation, both topics have dominated recent news coverage, so it’s important to understand the difference.

Fiscal policy

Paying tax is an unavoidable fact of life, but is needed to support spending on government services such as hospitals, roads, schools and defence. Taxation and spending decisions are made on different scales at every level of government, and form the basis of a government’s fiscal policy.

Traditionally, fiscal policy was seen as a very simple equation.

Governments should spend only as much as they earn through taxation, and only take on a small amount of debt for things like longer-term infrastructure projects.

But when economic growth falls, tax revenues also fall, forcing governments to cut spending to balance their budgets. Such spending cuts come at precisely the wrong time and are only likely to further worsen economic growth.

Noticing this pattern, economist John Maynard Keynes was the first to question this traditional wisdom, arguing that fiscal policy should be “countercyclical”.

According to Keynes, when economic growth falls, government spending should increase, only falling back as the economic recovery plays out.

Under a Keynesian approach, it’s therefore wholly appropriate for governments to issue debt to fund spending increases as the economy weakens.

The problem with this view of fiscal policy is that some governments have arguably abused their licence to spend, relying on ever-increasing levels of debt.

Greece famously suffered a spectacular debt crisis after the global financial crisis in 2008, but other European countries such as France, Italy, Portugal and Spain also have high and problematic levels of debt.

Chronically high debt can lead to higher interest payments on this debt, which in turn can limit a government’s ability to spend to support its economy.

Monetary policy

Monetary policy affects the economy via a different lever.

By changing the relative cost of borrowing money, changes in interest rates affect the aggregate level of spending in the economy.

This in turn can impact inflation – increases in the general level of prices.

Cuts in interest rates will tend to stimulate demand and push prices up, while rate increases reduce demand and push prices down.

Interest rates are typically set by a country’s central bank, whose primary role is to keep inflation low.

Our own central bank – the Reserve Bank of Australia, sets rates to meet an official inflation target of between 2% and 3%.

A combined Keynesian approach

Alongside Keynes’ writing on fiscal policy, he and other economists argued that interest rates should be reduced as an economy heads into recession, to support borrowing and spending by businesses and consumers.

Coupled with higher government spending, keeping interest rates lower in a recession should theoretically speed up economic recovery.

The merits of a Keynesian approach were borne out clearly in Australia in both the 2008 global financial crisis and the COVID pandemic.

Most recently, the pandemic saw the Reserve Bank cut interest rates to almost zero. Simultaneously, the government supported the economy with a wide range of spending programs, including big boosts to welfare payments and a generous JobKeeper program to mothball Australia’s workforce.

As a result, unemployment quickly returned to low levels and economic growth recovered following the lifting of restrictions.

Helping people pay their bills while taming spending is hard

Emergence from the pandemic left us with a different problem. Inflation surged and remained stubbornly above the Reserve Bank’s target range, forcing the bank to repeatedly raise rates to try to tame it.

At the same time, the government has been trying to support Australians through a cost-of-living crisis.

Now, critics of the government have argued that further spending to support Australians could unintentionally put further pressure on inflation and force the Reserve Bank to keep interest rates higher for longer.

Such challenges reflect the fact that our understanding of best practice for fiscal and monetary policy is constantly evolving.

Problems with burgeoning state debt have prompted debate on the former, and whether there should be limits on governments’ ability to issue debt.

These could include limits to public debt, or new oversight authorities to monitor levels of public spending.

And on monetary policy, a recent review of the Reserve Bank considered requiring a “dual mandate” that would force it to give equal consideration to employment and to inflation goals, as is currently required of the US Federal Reserve.![]()

Mark Crosby, Professor, Monash University

This article is republished from The Conversation under a Creative Commons license. Read the original article.

Saturday, 4 May 2024

Nestle baby food sugar study causes concern in India, Nestle India's shares fall

IANS: The baby-food brands sold by global giant Nestle in India contain high levels of added sugar, unlike the same products in the UK, Germany Switzerland, and other developed nations, revealed an investigation by Swiss organisation Public Eye and the International Baby Food Action Network (IBFAN), sparking concern in the country at the violation of health guidelines.

IANS: The baby-food brands sold by global giant Nestle in India contain high levels of added sugar, unlike the same products in the UK, Germany Switzerland, and other developed nations, revealed an investigation by Swiss organisation Public Eye and the International Baby Food Action Network (IBFAN), sparking concern in the country at the violation of health guidelines.Thursday, 2 May 2024

Five Things Chinese Investment Means for Zimbabwe

- By Fani Zvomuya Correspondent: President Mnangagwa recently toured the Manhize Steel Plant, a bustling investment near Mvuma that is the face of steel manufacturing revival in Zimbabwe; and the lofty position the country will attain as Africa's giant.

- The Manhize Steel Plant is owned by Chinese company Tsingshan Holding's local subsidiary, DINSON Iron and Steel. The steel plant has just begun production of pig iron and will in the course of the year manufacture steel billets and bars, all necessary for the steel industry which supports various sectors of the economy such as construction, agriculture, mining and so on.

- Dinson's Manhize plant will be the biggest in Africa at its peak, according to its projected phases; and this fact bears quite some symbolism, as China helps Zimbabwe to rise from the ashes and become a shining example.

- The country's own steel manufacturing had been battered because of the collapse of a State entity, Ziscosteel; and massive de-industrialisation that has taken place in the past two decades, mostly due to sanctions imposed on Zimbabwe by Western countries. Zisco was among entities initially put under the embargo.

- While addressing stakeholders during the Manhize Steel Plant, the President underlined the importance of Chinese investments in the southern African nation.

- He said: "I applaud companies from the People's Republic of China for the continued investments in our economy. This investment through Dinson Iron and Steel Company signifies more than just financial support; it represents a shared vision for a brighter future between Zimbabwe and China."

- This article unpacks the significance of Chinese investments in Zimbabwe, and the benefits of greater cooperation between the two countries.

- In particular, there are five key attributes of Chinese investments that underline the importance of Chinese foreign direct investment as a function of the comprehensive strategic partnership between the two sides.

- From size and speed, to spreading tentacles in Africa

- The first key attribute of Chinese investments in Zimbabwe, which Manhize steel project signifies is size.

- China is one of Zimbabwe's major source of Foreign Direct Investment, and it is no surprise that the biggest projects that the country has set up have come from China to the Manhize steel project is worth US$1.5 billion.

- What is important to note is that it is at the apex of a value chain comprising of production of ferrochrome and coking coal, which means that Dinson is the only company with such a well-knit business concept, worth close to US$3 billion.

- Dinson sister companies, Afrochine (ferrochrome) and Dinson Colliery (coking coal) have been the major producers and exporters of their respective products in Zimbabwe.

- The Dinson group also owns Gwanda Lithium as it pivots to new energy materials as part of its investment portfolio, which may include other minerals such as copper.

- Size matters. The Tsingshan group, the largest steelmaker and a Fortune 500 company, is showing the extent of Chinese investments in the country.

- There are a number of investments that are also big in size and scale.

- These include two major mining projects in the lithium sector through Sinomine Bikita Lithium, and Zhejiang Huayou Cobalt's Prospect Lithium Zimbabwe which have opened over the past two years.

- The projects were worth close to US$2 billion combined in investments.

- The biggest future and prospective investments in Zimbabwe will likely to be Chinese.

- These include a battery manufacturing plant in Mapinga, Mashonaland West; as well as the US$1 billion floating solar farm in Kariba.

- The second key attribute of Chinese investments in Zimbabwe is speed.

- Many projects done by Chinese companies have been completed in record time, as they have breezed through construction to begin operations quickly and efficiently.

- Rapid progress seen on Chinese projects has been seen by many locals as a thing of marvel.

- It is China speed. Projects such as Prospect Lithium Zimbabwe's Arcadia lithium plant, which was constructed in under one year, when ordinarily it would take at least 18 months, have attested to the sense of urgency and purpose as well as unmatched work ethic of the Chinese.

- The third attribute is that Chinese investments are impactful.

- The impact of Chinese investments has been huge. Zimbabwe has over 100 large and medium scale companies involved in various significant economic endeavours.

- China has also become an employer across various sectors. Apart from providing jobs and steering the economy through revenue streams to the fiscus, Chinese investments have come with social impact through corporate social responsibility assisting communities with education, health and other social needs.

- Sinomine Bikita Minerals has in the past year drilled nearly 40 boreholes in Masvingo Province, as well as upgrading roads. The company will also build a bridge in Manicaland.

- Bikita Minerals has also brought electricity to local businesses and homesteads, which are benefiting from its investment in power infrastructure valued at millions, something similar to what Dinson Iron and Steel has also done through a 90 kilometre 400kva power line from Sherwood in Kwekwe to the plant.

- Bikita Minerals has a football team that won promotion into Zimbabwe's top flight, the Premier Soccer League, underlining the diversity of its impact portfolio, as football is not just a social force but also an employer in itself.

- Chinese companies have also had impact on activities that have enhanced local value chains, becoming a key cog in running Zimbabwe's economy. Add to this, the transfer of skills and technologies that are benefiting local people.

- Fourth, Chinese companies are transformative. Chinese companies are assisting Zimbabwe modernise its economy and pushing industrialisation, with Manhize steel being the metaphor for the industrialisation drive as steel is at the centre of development.

- Historically, steel is a key driver of industrialisation and a Chinese company is at the centre of it all.

- Dinson Iron and Steel managing director, Mr Benson Xui -- captured it succinctly when he described the transformation power of the company's investment, relating that: "I saw mountains of iron ore and saw an opportunity for us to achieve the steel project in Zimbabwe and for Zimbabwe." (This was corroborated by President Mnangagwa stating that, "Over the years, the full potential of our iron ore resources and value chains have remained largely untapped.

- "However, under the Second Republic, the milestones we are realising through exceptional teamwork, focus and determination from both public and private sector have seen the establishment of this national strategic project."

- He also said it was pleasing that Zimbabwe's iron ore will be fully exploited, value added and beneficiated locally so as to realise maximum benefits from local natural resources, while also capitalising on the value chains including processing, manufacturing and the supply of high-value finished steel goods and products.)

- Value addition is key to economic transformation and this is being driven by Tsingshan investments in Zimbabwe, which has lots of natural resources and a yet to be realised value of unmined assets, added to vast human resources, a perfect climate and a huge repository of human capital.

- In this process, there is massive development of infrastructure and support services, which are set to impact on the whole of southern Africa, particularly in the south and south east where a value addition park will be established and attracting interest globally.

- Lastly, Chinese investments in Africa and in Zimbabwe particularly are stimulating and diffusional. Zimbabwe is thus positioned to become a nodal country, placing it firmly at the centre of the region, and becoming the gateway to Africa for investors attracted to opportunities linked to the exploitation and utilisation of natural resources.

- Zimbabwe and Africa are rising, and this fits neatly into the global economic matrices espoused in concepts such as China's Belt and Road Initiative and Global Development Initiative.

- Read the original article on The Herald.Five Things Chinese Investment Means for Zimbabwe

Friday, 5 April 2024

World Bank projects India’s economy to grow at 7.5 per cent in 2024

Saturday, 30 March 2024

Working from home is producing economic benefits return-to-office rules would quash

Shutterstock

Leonora Risse, University of Canberra

Shutterstock

Leonora Risse, University of CanberraMore of us have been in paid work this past year than ever before. A big part of that is because more of us have been able to work from home than ever before.

The proportion of Australians in paid work climbed above 64% in May last year, and has stayed there since. At the same time, unemployment has hovered around a half-century low of 4%.

In April last year, female unemployment fell to what is almost certainly an all-time low of 3.3%.

It’s working from home – actually, working from anywhere – that has been the game-changer, as the most enduring change to the way we work to have come out of the pandemic.

The jump in working from home

Before the pandemic, in 2019, the share of the workforce who usually work at least partly from home was 25%. Three years on in 2022, it was 36%.

These numbers from the latest Household, Income and Labour Dynamics in Australia (HILDA) Survey show there’s also been a shift in who’s working from home.

Before the pandemic, a greater share of men than women worked from home. Now it’s a greater share of women.

Among both women and men, the biggest jump has been among parents with young children.

The proportion of mothers with children under five working at least partly from home has leapt from 31% to 43%.

The working-from-home rate for fathers with children under five has jumped from 29% to 39%.

Which workers, which jobs?

Before the pandemic, managers and professionals were the workers most likely to work from home. They still are, with up to 60% dialling in from the home office for at least part of their work week.

But it’s clerical and administrative workers – occupations that are about three-quarters female – who had the biggest jump in working from home. Their pre-pandemic rate of 18% has soared to 42%.

In terms of industries, finance and insurance led the pack before the pandemic and still do, with rates doubling to 85%.

Working from home is now also the norm in information media and telecommunications (74%) and public administration and safety (72%).

In the traditionally male industry of construction, women’s working-from-home rates have soared from 34% to 45%.

It’s well above the men’s rate of 24%, which is largely unchanged.

While this reflects the different types of jobs that men and women do in construction, it also suggests working from home is a way to boost women’s involvement, even in this industry.

More workers, better-matched

The benefit of working from home for the economy has been fewer obstacles getting in the way of matching jobseekers to employers. Distance and location are no longer the deal-breakers they were.

Better job-matching means less unemployment, and the heightened prospect of finding a good job match encourages jobseekers who in earlier times might have given up.

In finance and insurance – the industry with the biggest and fastest-growing rate of working from home – the proportion of jobs that were vacant fell from 2.5% before the pandemic to just 1.7% by the end of 2023.

Return-to-office mandates would set us back

Making workers return to the office for jobs that can be effectively done from home would unravel the economic benefits that have been achieved.

Fewer people, especially women and parents with young children, would put themselves forward for work. The pool of skills that employers are looking for would shrink. And job-matching in the labour market becomes less efficient.

The result would be more Australians unemployed, and more Australians dropping out of the paid workforce, than if we had continued to embrace working from home.

Working from home still comes with challenges. Workers who are less visible in the office are more likely to be overlooked.

But it has a wider economic benefit we have a chance to hold on to.

The extraordinary transformation of our labour market means it shouldn’t be seen as a “favour” to workers, but as a favour to us all.![]()

Leonora Risse, Associate Professor in Economics, University of Canberra

This article is republished from The Conversation under a Creative Commons license. Read the original article.

Friday, 29 March 2024

What is the worth of one human being?

So, what is the price of one single human life? Answer could be that it is priceless. This answer is realised by most when it is too late.

A single human life, if appreciated, loved, respected and is in supreme bliss, can create the same situation and this feeling will be multiplied.

It is unfortunately not realised when all wrong policies are made and deathly results are realised, it is not realised when religion without its wisdom essence is pursued and the spirit (prana) within its core philosophy is not absorbed by the mind, it is not realised when information is mistaken for knowledge and it is not realised when one has lived an entire life merely implementing what others tells one to, whether it is appropriate to the self or not.

Each individual, like each country (a unique geographical location or earth with its own plant, animal and human species) and where this uniqueness created differently prioritised cities and knowledge structures. It is this difference that we have to thank for when we study how ancient Greek civilisation was different to ancient Egypt and how ancient Egypt was different to the Germanic or to the Indus people and the systems of knowledge they created.

One of the key drawbacks of modernity is that we have allowed globalisation to create a one-size-fits-all thinking that permeates all branches of life beginning with education. *Or else countries which never have apples growing in their soil, will not be teaching children that A is for apples!

The worth of one human life is linked to the worth of each and every resource which is in the land upon which that human life is birthed upon. When that land resource is not valued, or belittled or abandoned, the human life upon which it was birthed becomes equally abandoned.

However, some geographical locations (countries) which have learnt (often the hard way and after many atrocious mistakes) the value of maximising each life potential, making each human being feel loved, respected, cared for and appreciated, may benefit greatly by creating an opportunity or an atmosphere for any life to reach its full potential in a host soil (a foreign country).

Sometimes with well-meaning intention, these others, as neighbours sometimes do, for many diverse reasons, prescribe to other neighbour’s formulas and methodologies on how to care for the lives that are lived in, in other lands.

This is a most prevalent outcome of modern policy creation, where if a set of people disintegrate, feeling unhappy or sad about something in their own home or family where they feel their life potential is not maximised, they may ask the neighbours to tell their family members what they should do, or the neighbours will do in on their own, as they see fit. This may lead to new problems and most likely not be the solution.

A country is nothing but a large collective of individuals living in a setting of valuable resources and great potential.

We sometimes see a set of people pulling together to make countries which have very little naturally given resources, for example, like Singapore.

The value of one single human being cannot be priced because for better or worse, they can bring absolute prosperity or absolute disaster upon themselves or their surroundings. They do it by thinking uniquely, by thinking wisely and realising the importance of the mammoth and fragile task of preventing a feeling or hurt or resentment in a human being.

For example, one single human being such as Lee Kuan Yew, sat and thought deeply, and realised that whatever that is available (port resource) or the territory he and other people of that land lives, should be maximised and made successful enough to fill the gap of not having much other resources.

He did not get depressed that Sri Lanka was far more richer in natural resources and infrastructure at that time that Singapore, but carefully and methodically analysed the shortfalls that may occur if even a single person was hurt when setting forth the rules upon which to live each life in the particular land (policies of a nation).

Hence, we can say that Lee Kuan Yew and his life cannot ever be measured in monetary value because then it would have to be priced far more than what the country he created is worth because he maximised the potential of his mind to create this country upon which people are happy, healthy, thinking for itself and working hard. Of course, sometimes some may grumble as there will be critics of anything, this being earth of humans and not heaven of angels.

Why is this above reflection important today for Sri Lanka and Sri Lankans?

It is important because we have to start asking ourselves whether we are thinking or whether we are ‘thought for’ by our neighbours, irrespective of whether such a stance is taken in the best of intentions which is often the case. What good intentions is a family member who must put the house right. A solution given by an outsider often aggravates the situation.

Each individual will fail in the overall task of living a fulfilling life if they merely follow the framework a neighbour gives them. Likewise, a country will fail if they follow a framework that is merely given by others.

A country that is to maximise its potential is hinged on the thinking power of its people; beginning with each and every single human being. The power of one, is the power (or detriment) of all, as the lived in life of this world and its experiences show us.

We are now beginning to be caught in a storm brewing around the 13th Amendment to the Sri Lankan Constitution as introduced with Indian intervention in 1987.

Today there are different people holding different views on what a full implementation of such a policy would mean.

Leaving these debates aside, is it not useful to think anew at how all rural areas in all of the country could reach its fullest heights in wellbeing, education, creativity, innovation, invention, self-sufficiency, happiness and monetary as well as spiritual realisation and thus achieve true sustainable development as villages of this nation always had traditionally achieved?

Today all children learn about Colebrook and Cameron commissions which were initiatives of Colonial rule. The tradition of villages governing itself dates back to the earliest heritage accounts of Sri Lanka but today as with all knowledge of the policies of our ancient kings this knowledge is lost. We look to others before learning from our own monarchs.

The wisdom of our monarchs, of our physicians and the incredulous feats they achieved for our nation remains in the tombs of our minds. The village administrative models around the concept of village councils are very old in this civilisation. From the time of Kuweni, it is known for those who relentlessly search for this knowledge, that villages in all of the island were administered as suited to its particular human and land resource.

The greatest model of pluralism of the Buddhist philosophy as preached by the Enlightened Human Being the Buddha, remains unexplored by our minds.

Great sages such as the Buddha, Jesus, Mahavira, Mohammed and multitude of other saints of a Hindu and Sufi and other traditions spent their entire lives improving the value of their heart and mind, the two conjoined machines that power each single human life, by creating the attitudes and actions.

These were single human beings who thought for themselves and beyond the existing normality. They were social leaders while being spiritual masters. This country has much to learn from the individual actions of great Sinhala kings who created an incredulous hydraulic civilisation and stamped upon our consciousness the importance of sustainable policies.

Yet, today, unlike the gurukulam system of yesteryear, we are unaware of these great individuals. Likewise, the greater picture of why we are learning anything is lost upon us. In the same way, the fact that each of us can be a great vessel of unique productivity for our nation is not impressed upon us.

Thus, most of us and our countries in this modern world, copy and become photocopy versions of others, whether these versions are suited to us or not. Our education system gives us information but very little space to think, reflect and be wise in order to create the best version for each of our lives so that we do not create unhappy, frustrated, unkind, unempathetic lives for either ourselves, others or the land upon which our sustenance depends. Yet we are all books of knowledge. Each day of our lives such knowledge is written for us and this is called life experience. The challenges our country has faced is part of this experience we have lived through. As we see new challenges emerge, let us think for ourselves anew, how we can create solutions and those that last so that we are truly independent individuals and living is a country that creates its own solutions. Each thinking human being is a priceless treasure for this nation and as such able to move ahead of herd based thinking or emotion.

NOTE: This article is the first of a series of creating a possible platform to start a discourse on ancient village administrative systems of Sri Lanka, to glean what is useful for today’s context. What is the worth of one human being? | Daily FT

Wednesday, 28 February 2024

Sustainable Energy Authority approves permit for $ 355 m Adani Green Energy in Pooneryn

- Indian giant ignites green revolution with 234 MW wind energy project

- In a groundbreaking stride towards a greener tomorrow, Sri Lanka Sustainable Energy Authority (SLSEA) has approved to grant the Energy Permit to Adani Green Energy (Sri Lanka) Ltd., for its monumental $ 355 million, 234MW Pooneryn Wind Energy Power Project, nestled in the picturesque Northern Province of Sri Lanka.

- This landmark endeavour not only marks Sri Lanka’s largest single location wind energy project, but also heralds a new era of renewable energy dominance, addressing critical issues like the energy crisis, economic recovery, and environmental sustainability.

- This $ 355 million, 234MW, Pooneryn Wind Energy Power Project stands tall as a testament to Adani Green Energy’s unwavering commitment to pioneering sustainable solutions. This colossal initiative not only cements its status as Sri Lanka’s largest wind energy project at a single location but also emerges as a beacon of hope, addressing critical concerns such as the energy security, economic revitalisation, and environmental stewardship.

- The Pooneryn Wind Energy Power Project is set to become a beacon of sustainable energy in the region. With a capacity of 234MW, it is poised to contribute substantially to Sri Lanka’s renewable energy capacity. The project aligns seamlessly with global efforts to combat climate change by reducing carbon emissions, as wind power is renowned for its clean and green attributes. Adani Green Energy’s commitment to environmental stewardship is evident in this endeavour, making strides towards a cleaner and more sustainable future.

- Sri Lanka has been grappling with an energy crisis, facing challenges of energy security and sustainability. The Pooneryn project emerges as a beacon of hope, offering a reliable and renewable solution to the nation’s energy woes. By harnessing the power of wind, this project promises to diversify Sri Lanka’s energy mix, reducing dependence on fossil fuels and mitigating the risks associated with fluctuating energy prices and supply shortages.

- Amid the economic turmoil wrought, the $ 355 million Pooneryn Wind Energy Power Project serves as a ray of economic optimism and a vote of confidence in Sri Lanka. Adani Green Energy’s bold investment in this transformative project not only injects vital Foreign Direct Investment (FDI) into Sri Lanka’s economy but also sends a resounding message of confidence to investors worldwide. This influx of capital is poised to catalyse economic growth, create jobs, and stimulate local businesses, laying the groundwork for a robust and resilient post economic pandemic recovery.

- The Pooneryn Wind Energy Power Project brings with it a boon of employment opportunities, particularly in the Northern Province. The construction, operation, and maintenance of the facility will create a multitude of jobs, contributing to the economic upliftment of the region. This strategic focus on the Northern Province underscores Adani Green Energy’s commitment to inclusive growth, fostering a sense of community and empowerment among the local population.

- At its core, the Pooneryn Wind Energy Power Project embodies Adani Green Energy’s unwavering commitment to environmental stewardship. By harnessing the limitless power of wind, the project is set to significantly reduce Sri Lanka’s carbon footprint, paving the way for a cleaner, greener future.

- With stringent environmental measures and best practices in place, Adani Green Energy is not only mitigating environmental impact but also setting a gold standard for responsible and sustainable development in the energy sector. The integration of sustainable practices in energy generation aligns with global efforts to preserve natural resources and protect the delicate balance of our ecosystems.

- The Pooneryn Wind Energy Power Project is much more than just a power plant; it’s a symbol of hope, progress, and possibility. As it takes shape against the backdrop of the Northern Province’s majestic landscapes, it stands as a beacon of Sri Lanka’s commitment to a brighter, more sustainable future. With Adani Green Energy leading the charge, the journey towards a greener tomorrow has never looked more promising. Sustainable Energy Authority approves permit for $ 355 m Adani Green Energy in Pooneryn | Daily FT